#How to use RSI with Three White Soldiers pattern

Explore tagged Tumblr posts

Text

How to Trade the Three White Soldiers Pattern: Strategies and Examples

Technical analysis offers traders a wide range of candlestick patterns to predict price movements. One of the most reliable and bullish reversal patterns is the Three White Soldiers. This pattern, when used correctly, can signal a strong trend reversal and provide profitable trading opportunities. In this post, we’ll explore what the Three White Soldiers pattern is, how to identify it, and…

#Best strategies to trade the Three White Soldiers pattern#breakout trading patterns#Bullish candlestick pattern#Bullish Reversal Pattern#bullish trend reversal#candlestick chart patterns#Candlestick pattern confirmation#How reliable is the Three White Soldiers candlestick pattern#How to identify Three White Soldiers on a chart#How to trade Three White Soldiers#How to use RSI with Three White Soldiers pattern#Identifying Three White Soldiers#Intraday trading strategy using Three White Soldiers#Japanese candlestick patterns#learn technical analysis#Price Action Trading#Risk Reward Ratio#stock markets#stock trading#Stop Loss Strategy#successful trading#support and resistance zones#technical analysis#Technical analysis candlestick patterns#Three White Soldiers candlestick#Three White Soldiers candlestick pattern in stock trading#Three White Soldiers confirmation#Three White Soldiers pattern#Three White Soldiers pattern example#Three White Soldiers pattern with volume confirmation

0 notes

Text

Best Indicators for Swing Trading in 2022 - Library of Trader

Swing trading indicators can come along and change the whole game as they ease the process but also provide many false signals. Such a double-edged benefit of technical tools makes many swing traders hesitate about whether they should use these indicators. This article offers an exclusive overview of the common technical indicators for swing trading. So, you can learn how to leverage their superior functions to help you earn higher profits from swing trading.

What’s Swing Trading and How Does It Work?

Swing trading indicators a type of fundamental trading where you can hold positions longer than a single day. Technical analysis plays an important role in the development and modification of swing trading strategies.

The Importance of Understanding Swing Trading Indicators

There are three aspects of a trade that you should take into consideration, trends, momentum, and volume. Thus, the help of tools in such areas can help you profitably swing trade no matter how volatile the market is.

Trend Indicators.

Momentum Indicators.

Volume Indicators.

Top Swing Trading Indicators

Moving Averages (MAs)

Moving averages (MAs) are a stock indicator that you typically find in technical analysis. This tool can mitigate short-term fluctuations in stock prices over a specified time frame. So, the price data becomes much more understandable and generates more valuable insights.

Volume

Volume is also a technical analysis tool that many swing traders use to better analyze the strength of a new trend – whether it can last or not amidst multiple influential factors. The underlying principle is simple: if a trend comes along with a high volume, it shows much more strength than the trend with a weak volume.

Ease of Movement (EOM or EMV)

Ease of Movement indicator clarifies the relationship between price and volume so that the strength of an underlying trend can be under the spotlight. Simply put, the tool helps swing traders determine whether prices can rise, or fall, with little resistance in certain movement directions.

Relative Strength Index (RSI)

Relative strength index is helpful to determine whether a stock’s price is strong or not. So, it is among the crucial momentum indicators in technical analysis. Specifically, it gauges the speed and magnitude of an asset’s recent price changes to assess overvalued or undervalued conditions.

Stochastic Oscillator

Stochastic oscillator is an indicator that has the same operating system as the RSI. It indicates the market movements through the comparison of the closing price of a market to the range of its prices in a specific period. The difference between a stochastic oscillator with RSI is the inclusion of two lines – one indicates the current value of the oscillator, and another line shows a three-day moving average (MA).

MACD

MACD stands for Moving Average Convergence Divergence. This trend-following momentum indicator points out the relationship between two moving averages of an underlying asset’s price. You can get the result of MACD by subtracting the 26-period EMA from the 12-period EMA.

Bollinger Band

A Bollinger band, a technical analysis tool, entails a group of trendlines with two standard deviations. These deviations are apart from a simple moving average (SMA) of an asset’s price. A well-known technical trader, John Bollinger, was the man behind this tool. He developed this tool to uncover the opportunities that enable swing traders and investors to accurately identify the timing of an overbought/oversold asset.

Bullish Candlestick Reversal Patterns

There are five powerful patterns that showcase bullish candlestick reversals, such as hammer, piercing, bullish engulfing, morning star, and three white soldiers.

The creation of a hammer pattern takes place when the open and close prices meet each other. It comprises a lower shadow that is twice as long as the real body.

Piercing pattern is a candlestick pattern that offers us potential bullish reversal signs near the support levels when a downtrend ends.

Bullish engulfing informs a potential reversal from a downtrend as more buyers join the market and move the prices up after a long period of downward movement.

Morningstar is a triple pattern of candlesticks telling us a bullish reversal in advance. In other words, it warns us of the upcoming uptrends.

Three white soldiers, also a bullish candlestick pattern, takes place at the end of a downtrend and showcases a bullish reversal. It includes three long bullish candlesticks that are green in color but not long shadows.

Other Indicators used for Swing Trading

Support and Resistance

Support and resistance refer to areas on a market’s chart with challenges of crossing. They create the basis of main technical strategies for many trading types, and swing trading is no exception.

Patterns

There are many swing trading patterns that you can use as hints for potential uptrends and reversals.

Wedges help you identify reversals. If a wedge falls on a falling market or rises on a rising market, it can be a signal of an upcoming price reversal.

Pennants can be a factor leading to new breakouts as the market consolidates after a considerable price action.

Triangles are a precursor to a breakout in the case of the pattern’s invalidation.

Standard head and shoulders are the pre-ups for bear markets. Meanwhile, inverse ones can be the beginning of uptrends.

How to Start Using Swing Trading Indicators

These tools will be a great help for swing traders to identify the timing and methods of opening trade or position. You can find optimal entry points with the aid of the signals that the superior features of these tools can offer.

Why Should use Swing Trading Indicators

The swing trading indicators that we introduce in this article are the basic tools that many swing traders have used to better their trades. You can see those indicators showcase three primary dimensions of a trade, including trend strength, momentum, and volumes. Article Source: https://libraryoftrader.net/swing-trading-indicators

0 notes

Text

Avoid the ‘bull trap’ in trading.

12 June 2020,

Do you know what a ‘mirage’ is? Sometimes light reflects on sand in such a way that it creates an illusion of water—called mirage. So thirsty travelers in the desert may feel like they’ve found water, but on getting closer, they realize it’s just sand. Such a mirage exists in markets too; it’s called the bull trap. In a ‘bull trap’, buyers enter a trade after a small price rise, assuming the trend will last and they’ll make profits. But when the stock does not deliver, their confidence gets affected, sometimes discouraging them from trading altogether. Want to avoid such bull traps? Know how to identify them in this Technical Funda. Here's how you can identify and avoid 'bull traps' while trading Avdhut Bagkar | Business Standard A 'bull trap' is a classic case of a false breakout. In general, buyers enter a trade with strong conviction of an upside. However, at times, the stock fails to deliver the upward move and instead hits the trader's stop loss or support levels. Such instances not only affect the trader's morale, but they also start to doubt their trading strategies. Every other triggered stop loss then induces “fear of uncertainty” in the trader and the feelings of “staying away” enters his/her system. How to identify a bull trap? Before entering into a trade, one needs to gauge the overall outlook of the stock market. If the trend is certain and upward, the trade you enter may not need extra caution. Trading with the trend also helps in building a strong “trading confidence”. Moreover, one should have the knowledge of the sector or index from which you want to select a stock. In some cases, the market trend might be volatile, but some specific sector/ index may exhibit strong momentum. If the index outlook is positive, identifying a stock gets easier. Avoid trading in stocks that are vulnerable to any corporate developments. Such situations exhibit uncertainty and potential volatility rise as the development starts to pour into the markets. How to avoid a bull trap? Once the stock breaks out, wait for the rally to sustain with decent volumes. Volatility in volume structure reflects uncertainty and indecision. It is better to hold nerves and let the price settle, keeping behind all the swings it has witnessed. Make use of two – three technical / price indicators for a substantial confirmation. One can rely on a single indicator, however, having more than one indicator helps gauge the right momentum. That said, having more than three indicators can also create confusion. Thus, the ideal strategy should be to rely on limited technical indicators. Indicators to track Moving Averages: The major moving averages are 50-day moving average (DMA), 100-DMA and 200-DMA. While identifying a trade, list down stocks that are trading above these averages. Trading in stocks hovering below these averages increases the risk in terms of identifying strength, direction and momentum. Chart Patterns / Candlestick patterns: Chart patterns like Inverse head and Shoulder, Double bottom, Falling channel pattern, Symmetrical triangle, and Ascending triangle assist in confirming a positive outlook. Candlestick patterns like Bullish engulfing, Morning Star, Piercing line, Three White soldiers, and Hammer are bullish indicators. RSI, MACD: The two widely used indicators are Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). RSI determines the strength in oversold and overbought conditions; also, crossovers determine the positive upside. Whereas, MACD facilitates in evaluating the underneath buying momentum, by identifying the direction on the zero line and crossovers. One needs to develop strategies that provide confirmation based on the correlation of these indicators. A confirmed trade is said to have all these indicators giving a 'buy' signal. If any of the indicators isn't signalling a 'buy', it may increase the quantum of risk in a trade. What to do when you fall in a bull trap? The first response should be to exit the trade, rather than getting emotionally attached to the feeling of making profit. If one fails to exit, the loss may widen and even lead to a disastrous situation going ahead. Click here for Bank Nifty chart The price will tell you if it is a 'bull trap'. One way to identify a 'bull trap' is the swings with volatile volumes seen after the breakout levels. If the breakout is not a trap, then the price will show a consistent rise with closing above the previous high, at least for two – three sessions after the breakout neckline.

0 notes

Text

Advanced Technical Analysis Trading Strategies (NEW 2019)

http://bit.ly/385qWqm Advanced Technical Analysis Trading Strategies (NEW 2019), Advanced Technical Analysis Hacks For Stock Trading, Options Trading, Day Trading, Swing Trading & Financial Trading. Attention Traders, Investors & Stock Market Lovers! Finally You’ll Discover The Secrets to Boosting Your Trading Profits Regardless of Any Market Conditions. Get Results or Your Money Back! The Advanced Technical Analysis Trading Strategies Course is designed to bring you an ultimate blueprint and technical analysis hacks that can help you easily double or even triple your trading returns in a short period of time. In this course, you’ll be able to level up your trading skills and master how to trade flat and choppy markets effectively using dozens of our proven advanced price action trading strategies. You’ll also learn a lot about trading psychology, risk management, how to develop a winning mindset, and how to trade over 20+ best performing candlesticks and chart patterns. What you’re going to learn in this course can be applied for trading securities in any freely traded markets around the world. These include stocks, options, forex, cryptocurrencies, ETFs, and even bonds. In this course, you will learn… Master Advanced Technical Analysis Strategies for Traders & Investors With Real World Examples Included! How To Upgrade Your Trading Skills in No Time With These Proven Technical Analysis Techniques How to Trade Flat & Choppy Markets Support and Resistance Levels Fibonacci Levels Exponential Moving Average (EMA) Moving Average Convergence Divergence (MACD) Relative Strength Index (RSI) Relative Vigor Index (RVI) How to Trade Choppy Markets How to Trade Flat Markets How to Develop a Winning Trading Mindset How to Maintain Your Trading Focus and Mental Health How to Avoid Blowing Up Your Account With Risk Management Tactics How to Master Advanced Price Action Trading Techniques How to Trade Advanced Chart Patterns Double Tops and Bottoms Head and Shoulders Cup and Handle Wedges and Triangles Flags and Penants How to Trade Advanced Candlestick Patterns Hammer and Hanging Man Inverted Hammer and Shooting Star Bullish and Bearish Harami Bullish and Bearish Engulfing Morning and Evening Stars Three White Soldiers and Three Black Crows And a lot more… What is more? You will get a lifetime access to this course, without any limits! The course will keep updating frequently with more up-to-date learning resources. Get dedicated support from the course Instructors and the learning community anytime you need! You will also get a 30-DAY MONEY BACK GUARANTEE, so don’t hesitate to give yourself a chance to learn new things by just taking this course now! So let me ask you this… Will your investment portfolio grow much faster in the next 12 months after mastering these advanced technical analysis trading strategies … Do you have some money to invest? Are you reasonably intelligent? Does your family need extra care or support? Are you willing to learn a new skill that guarantees you a second income for the rest of your life? Would you like to work less and make more? I will assume your answers are the same as mine… Then You Have 2 Clear Choices 1. Keep doing things the way you have been and remain frustrated, lose money and simply get use to your average life… or 2. Enroll in The Advanced Technical Analysis Trading Strategies Course and start generating consistent income and never worry about money ever again. Now You Have a Big Chance to Upgrade Your Trading Skills Listen, if you don’t get how important learning technical analysis is then don’t enroll in this program. Keep shlepping away in the same manner you have been, maybe you’ll get a different result 🙂 In that case, you’re going to wake up 6 months from now, with everything still very much the same as it is today – don’t know how to trade, have no clue about what’s going on with your money, stress, feel frustrated… you know how it goes. Is that you want for yourself? No. I don’t want that for you either… which is why I want you to do something right now. Sign up for this course, be one of the few students who master these proven strategies, and start growing your investment portfolio today. Simply click the Enroll Now button to get started now!

0 notes

Text

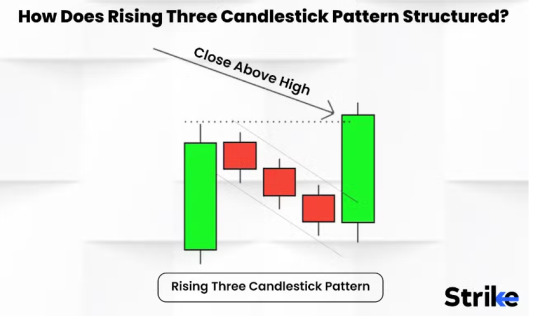

🔥 Complete Guide to Rising Three Candlestick: How to Spot & Trade This Bullish Pattern

If you're into price action trading, you've probably heard of candlestick patterns like engulfing, doji, or three white soldiers. But one underrated gem? The Rising Three Candlestick Pattern — a strong bullish continuation signal. This guide breaks it down without fluff. Simple language, real Indian stock examples, and data-backed trading insights.

📌 What Exactly Is the Rising Three Candlestick Pattern?

The Rising Three Candlestick Pattern is a five-candle formation seen in technical analysis. It appears in an uptrend and signals that bulls are pausing — but far from finished.

Core Characteristics:

First candle: Long bullish (green) candle

Middle three candles: Small-bodied bearish (red) candles, staying within the range of the first candle

Fifth candle: Strong bullish candle that closes above the first one

Think of it like:

Bulls take a breather, bears try to interrupt, but bulls come back stronger.

Steve Nison, the man who introduced Japanese candlestick charting to the West, emphasized this pattern’s ability to indicate trend continuation with high confidence.

📊 How to Identify Rising Three Without Getting It Wrong

Misidentifying candlestick patterns is a common pitfall. Here's how to spot Rising Three properly:

Must appear in a clear uptrend

The 3 bearish candles shouldn’t break the low of the first bullish candle

Final candle must close higher than the first candle’s high

Look for low volume in the 3 bearish candles, followed by high volume on the fifth

📈 Real Example (Indian Market): Look at Tata Motors on 1st Feb 2024. Post-budget rally showed a textbook rising three pattern on the daily chart. Strike Money charting tool confirmed breakout above ₹840 with strong volume.

🧠 What Makes This Pattern Work? The Psychology Behind It

The Rising Three pattern represents market psychology in action.

First candle: Bulls dominate

Middle candles: Bears try to regain control, but lack momentum

Last candle: Bulls reassert dominance, pushing price even higher

This pattern shows market confidence, not just price action. It’s a signal that smart money isn’t exiting the rally — just resting before the next push.

🚫 Avoid These Rookie Mistakes When Trading Rising Three

Even though it looks simple, many traders misuse this pattern.

Common errors:

Forcing the pattern in sideways markets

Ignoring volume (key for confirmation)

Not checking for resistance zones ahead

Entering before the fifth candle closes

📉 Example Gone Wrong: Zomato in May 2023 showed a near rising three on the 4H chart. But the final candle failed to break above resistance at ₹68 — pattern invalidated. Those who rushed in early got trapped.

🛠️ Here’s How to Trade the Rising Three Candlestick Pattern Like a Pro

Spotting the pattern is half the job. Trading it right is what matters.

✅ Entry:

Wait for the fifth bullish candle to close above the high of the first candle. Confirm with volume spike.

🛑 Stop Loss:

Place below the lowest wick among the middle three candles.

🎯 Take Profit:

Use previous resistance

Or Fibonacci extensions (like 1.618 level)

🚀 Example Using Strike Money: On 9th Jan 2024, Infosys formed a rising three on the hourly chart. Using Strike Money’s volume profile, entry was confirmed at ₹1,485 with a tight SL of ₹1,465. Target hit ₹1,520 within 2 sessions.

📈 Best Indicators to Confirm a Rising Three Pattern

While the pattern itself is powerful, combining it with technical indicators improves accuracy.

Recommended Tools:

Volume: Look for rising volume on the 1st and 5th candles

RSI: Above 50 = bullish strength

MACD: Bullish crossover = green flag

Support Zones: Use horizontal lines or Fibonacci

Pro tip: Strike Money lets you layer these indicators easily for confirmation.

🔍 Real Chart Examples from Indian Stocks: See It in Action

Here are actual instances where the Rising Three pattern worked beautifully on NSE stocks.

🟢 Example 1: ICICI Bank – Oct 2023 (Daily Chart)

Pattern appeared after a pullback

RSI at 58, MACD bullish

Breakout confirmed at ₹960

Hit ₹1,000+ in 5 sessions

🟢 Example 2: HDFC Life – July 2023 (15-min Chart)

Short-term rising three before an earnings breakout

Volume surged on 5th candle

Stock moved ₹14 in 3 hours

Use Strike Money to backtest these examples and overlay your indicators.

⚔️ How Rising Three Compares with Other Patterns

Confusing Rising Three with similar-looking patterns like Three White Soldiers or Bullish Engulfing is common.

Key Differences:

Three White Soldiers = 3 big bullish candles in a row

Bullish Engulfing = Just 2 candles (bearish followed by large bullish)

Rising Three = 5 candles, a pause, then continuation

Each pattern tells a different market story. Rising Three is a story of healthy consolidation, not aggressive reversal.

📊 Backtested Results: Is Rising Three Really Reliable?

Here’s what backtesting and research reveal about the Rising Three:

📌 Strike Money Internal Data (2022–2024):

Pattern detected: 812 times on Nifty 50

Win rate (when confirmed with RSI & volume): 68.7%

Average gain post-breakout: 3.5% within 5 candles

🧪 External Studies:

A study published in Journal of Technical Analysis (2021) ranked Rising Three among top 10 continuation patterns.

Steve Nison’s own backtests show the pattern performs better on daily and 4H charts.

🤔 Should You Rely on Rising Three for All Market Conditions?

No single pattern is a holy grail. But when used in the right context, Rising Three can be a valuable edge.

When to Use:

Trending markets (especially bullish sentiment)

Supported by fundamentals or news

Confirmed via indicators (RSI/MACD/Volume)

When to Avoid:

Choppy or sideways market

Just before earnings or macro events

Illiquid stocks

🔄 Quick Recap: What You’ve Learned So Far

✅ Rising Three = 5-candle bullish continuation pattern ✅ Works best in strong uptrends ✅ Use volume, RSI, MACD to confirm ✅ Works on daily, 4H, 1H charts ✅ Tools like Strike Money make detection easy ✅ Avoid low volume setups or forced patterns

🚀 Final Thoughts: Add Rising Three to Your Trading Arsenal

The Rising Three candlestick isn't the flashiest pattern — but it’s one of the most reliable for capturing continuation moves. If you're serious about price action trading and want to improve entries in trending markets, this pattern deserves a spot on your radar.

Strike Money, as a charting and backtesting tool, can help you identify and validate the pattern with live market data and advanced indicators.

📥 Ready to Spot This Pattern in Live Markets?

👉 Start using Strike Money to scan for Rising Three setups across Indian stocks, Forex, and Crypto 👉 Download your free Rising Three Cheat Sheet (PDF) 👉 Backtest this pattern on your favorite timeframes

0 notes

Text

These soldiers can help you win.

Some soldiers defend. Some soldiers help you emerge victorious.

In the stock market too, you can use three soldiers to help you be on top of changing trends.

Read this week’s Technical Funda to know more.

Three white soldiers can help you make money in the stock market

Avdhut Bagkar | Business Standard

In stock market trading, "three white soldiers" is a candlestick pattern that indicates a reversal in the downtrend. It consists of three continuous green candles with a strong close. Every next candle closes above the previous green candle high, signifying a likely change in the sentiment. On the charts, such a scenario reveals bulls getting aggressive with every weakness being bought into. Though the trading volume plays a crucial role in building and defining a trend, the volume structure may be kept aside if the strength in price is visible.

This pattern is viewed as an extremely bullish as continuous three positive closes indicate the beginning of a strong buying, which began with the first day’s move and got carried forward to the next two sessions. If this buying continues or holds the upward bias, the volume and investor interest also start to pick up pace.

Traders who are short on the security look to exit and traders who are waiting to take up a bullish position see the three white soldiers as an entry opportunity.

Key indicators

The pattern indicates a reversal in trend with downside capped at the lowest low of the green candle.

If this pattern succeeds in the short term, then the same support levels may act for the medium-term as well.

Normally, such patterns witness simultaneous / continuous upside. If that does not happen, and stock enters a consolidation mode and then it may signal may suggest weakness. In such a scenario, investors can exit.

When correlated with Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) indicators, the pattern can provide a more certain outlook for the stock.

Can be used for long-term investment if it appears on the monthly and yearly charts of a stock.

That said, not every rise in a stock can be attributed with this pattern. One needs to be careful and correlate this with the RSI or MACD. Besides, the closing of every green candle with minimum upper and lower shadow should be given prime importance.

Click here for Pidilite Ind chart

When trading the three white soldiers pattern, it's important to note that the strong moves higher could also create temporary overbought conditions. The relative strength index (RSI), for example, may have moved above 70 levels. In some cases, there is a short period of consolidation following the three soldiers pattern, but the short- and intermediate-term bias remains bullish.

Which formations of “three white soldiers” need to be avoided?

When the 2nd or 3rd green candle opening is above its previous candle close

In these three candles, if the scenario shows strong fluctuation on volumes on either side – a significant sharp rise or fall

The 1st candle low is broken by either two candles

Can you entirely rely on three white soldiers pattern?

The simple answer is no. One needs a trained eye and build a strategy around this pattern that can provide more trading opportunities and a better picture of how long to stay in the stock using this chart formation. There are different candlestick patterns that can also deliver good returns. Relying on a single candlestick would not provide trading comfort. Understanding and using the other candlestick patterns such as Morning Star, Evening star, Doji, Hammer, etc. will assist in identifying a larger trend. Once you can identify the three white soldiers, the trend from thereon will get easier to identify if other candlestick patterns are correlated with this.

The drawback of three white soldiers pattern is that there is no confirmed target for the stock though the trend continues to remain bullish and every upside is supportive of buying momentum.

Click here for Godrej Consumer chart

. The opposite pattern of three white soldiers is three black crows, which indicates a reversal of an uptrend.

0 notes